Back

"Oil consumption breaks all records in 2023 and will continue to rise in 2024"

20 November 2023

Analysis

The OPEC+ members will convene on November 26 in Vienna to decide on their production volumes. In the midst of the conflict in the Middle East and just days before COP 28, Francis Perrin, Research Director at IRIS and Associate Researcher at PCNS, provides an overview of the numerous challenges facing the organization.

About

Francis Perrin is an Associate Researcher at the Policy Center for the New South (PCNS, Rabat) and Research Director at the Institute of International and Strategic Relations (IRIS, Paris). He collaborates with the specialized weekly Petrostratégies and the annual report Cyclope on commodities (Editions Economica). To obtain more information on the subject or to know how Concerto can assist you, please contact us at insights@concerto-pr.com.EXPERT VIEW

Question 1: What is the impact of the Hamas-Israel conflict on the energy market, particularly on oil prices?

The war between Israel and Hamas had a bullish impact on hydrocarbon prices, but it lasted for approximately two weeks. The price increase, which remained relatively moderate at around +10-12%, was tied to concerns about the conflict spreading in the Middle East, a region that controls nearly 50% of proven oil reserves and 40% of proven natural gas reserves. Traders, however, were relatively quickly convinced, rightly or wrongly, that these risks were limited due to the deterrent military actions of the United States and ongoing diplomatic efforts. Additionally, global economic concerns, including those related to China and Germany, also contributed to a decline in crude oil prices. Oil prices have now fallen to levels lower than before October 7. Similar trends were observed for gas prices, with one significant difference: the increase in prices in the two weeks following October 7 was much stronger (over 30%). Israel is a gas producer and exporter, whereas it does not produce oil. Other factors, such as the attack on a gas pipeline in the Baltic Sea and threats of strikes in the LNG industry in Australia, also contributed to the rise in gas prices. Prices then sharply declined, but unlike oil prices, they currently remain slightly higher than their pre-October 7 levels. If the conflict remains limited to Israel and Hamas, there is no reason for oil and gas prices to experience a significant upward surge. However, the potential escalation of the war, especially involving Iran, could certainly change the situation. So far, this has not been the case, but it is not possible to completely rule out scenarios of escalation.Question 2: In this geopolitical context, what power dynamics are at play within OPEC+?

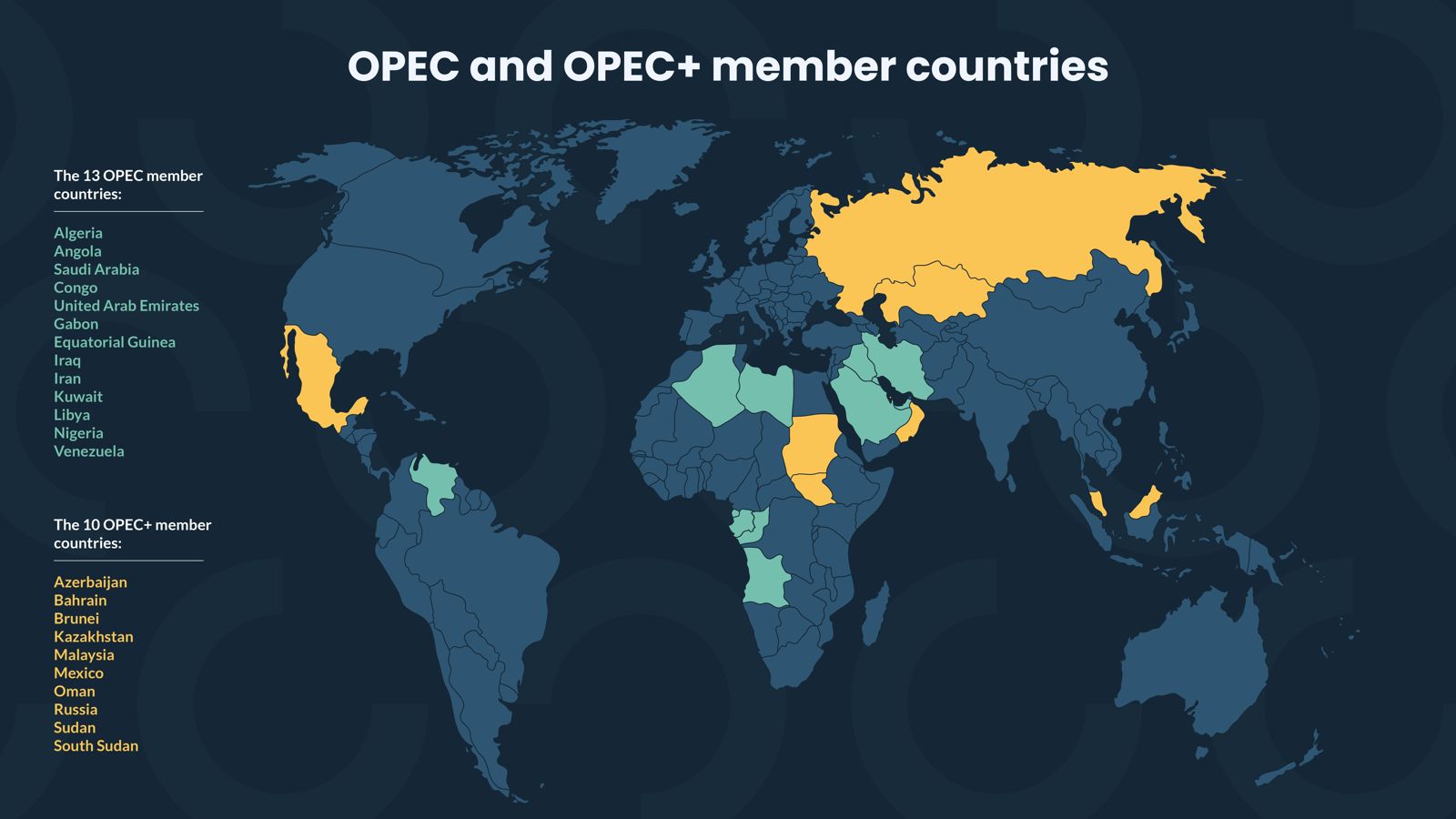

OPEC+ comprises 23 countries, including the 13 OPEC member countries and ten non-OPEC countries, including Russia. There are significant divergences among these nations, but they share a crucial commonality: all are dependent on oil and are thus willing to cooperate to influence the oil market and crude oil prices. Since the spring of 2020, OPEC+ countries have mostly succeeded in reaching agreements. Decisions are made by consensus, which is not straightforward with 23 member states, but the key step is to ensure that the two heavyweights, Russia and Saudi Arabia (respectively the second and third largest global oil producers after the USA), are in agreement. Without this, no decision is possible. For about three years, these two countries have been relatively well aligned, facilitating the decision-making process within the alliance. For the vast majority of OPEC+ countries, an oil price above $80 per barrel is a highly desirable goal, leading the coalition (or some of its components) to reduce production on several occasions since the fall of 2022. On Friday, November 18, in the late afternoon, the price of Brent crude for the January 2024 contract traded in London was slightly above $80 per barrel. Therefore, it is unlikely that the alliance will decide to increase production in the near future.Question 3: Just days before COP 28, and considering that several major hydrocarbon-producing countries have initiated massive investment plans for the energy transition (such as Saudi Arabia and the UAE), what are the prospects for the organization?

For oil producers, and more broadly those in the fossil fuel industry, international climate negotiations, such as the COP meetings, represent a significant challenge. OPEC closely monitors these negotiations and aims to defend the role of oil in the global energy system. Non-OPEC countries within OPEC+ share a similar stance. These countries often also have significant natural gas reserves and emphasize that natural gas, considered the "cleanest" or least environmentally impactful among fossil fuels, should play a crucial role in the energy transition. The Gas Exporting Countries Forum (GECF), also known as the Forum of Gas Exporting Countries (FPEG), supports this perspective for natural gas. Indeed, several OPEC+ countries have embarked on an energy transition, with the United Arab Emirates being among the most advanced, especially as it is set to host COP 28. However, these states do not intend to abandon hydrocarbons; quite the opposite. For them, the energy transition involves reducing the carbon content of fossil fuels, increasing energy efficiency, promoting the development of non-carbon energy sources, and heavily investing in carbon capture and storage, as well as in hydrogen and ammonia. There is, therefore, no contradiction in this vision between the importance of entities such as OPEC and OPEC+ and the energy transition. Furthermore, global oil demand continues to rise. Oil consumption is set to break all records in 2023, reaching approximately 102 million barrels per day (over 5 billion tonnes per year), and it will continue to increase in 2024. In the short and medium terms, the upward trend is certain. In the long term, it is less clear. The International Energy Agency (IEA) estimates that global oil demand is likely to reach a peak just before 2030, while OPEC believes it will continue to grow until 2045. In either case, oil will remain a very significant energy source for a long time. Therefore, OPEC and OPEC+ still have a bright future ahead of them.