Back

Benin launches ‘Vodun Days’ festival in a bid to capture more of West Africa’s rapidly growing tourist market

12 January 2024

Analysis

Benin has launched its ‘Vodun Days’ festival, a revamped version of traditional vodun celebrations taking place in Ouidah between the 9th to 10th of January. But as other coastal West African states such as Ghana and Senegal roll out ambitious tourist strategies, will Benin be able to attract international travelers in an increasingly competitive region?

QUICK INSIGHTS

- Global interest in West Africa as a tourist industry is growing rapidly each year, presenting huge opportunities for countries like Benin to boost tourism revenues

- But in a competitive region with well-established tourist markets, will Benin be able to compete with neighboring countries?

- To boost its chance of success, the government has launched the ’Vodun Days’ festival with the explicit intent of promoting the country’s rich cultural heritage and appealing to a wider international audience

Benin seeks to become a West African hotspot

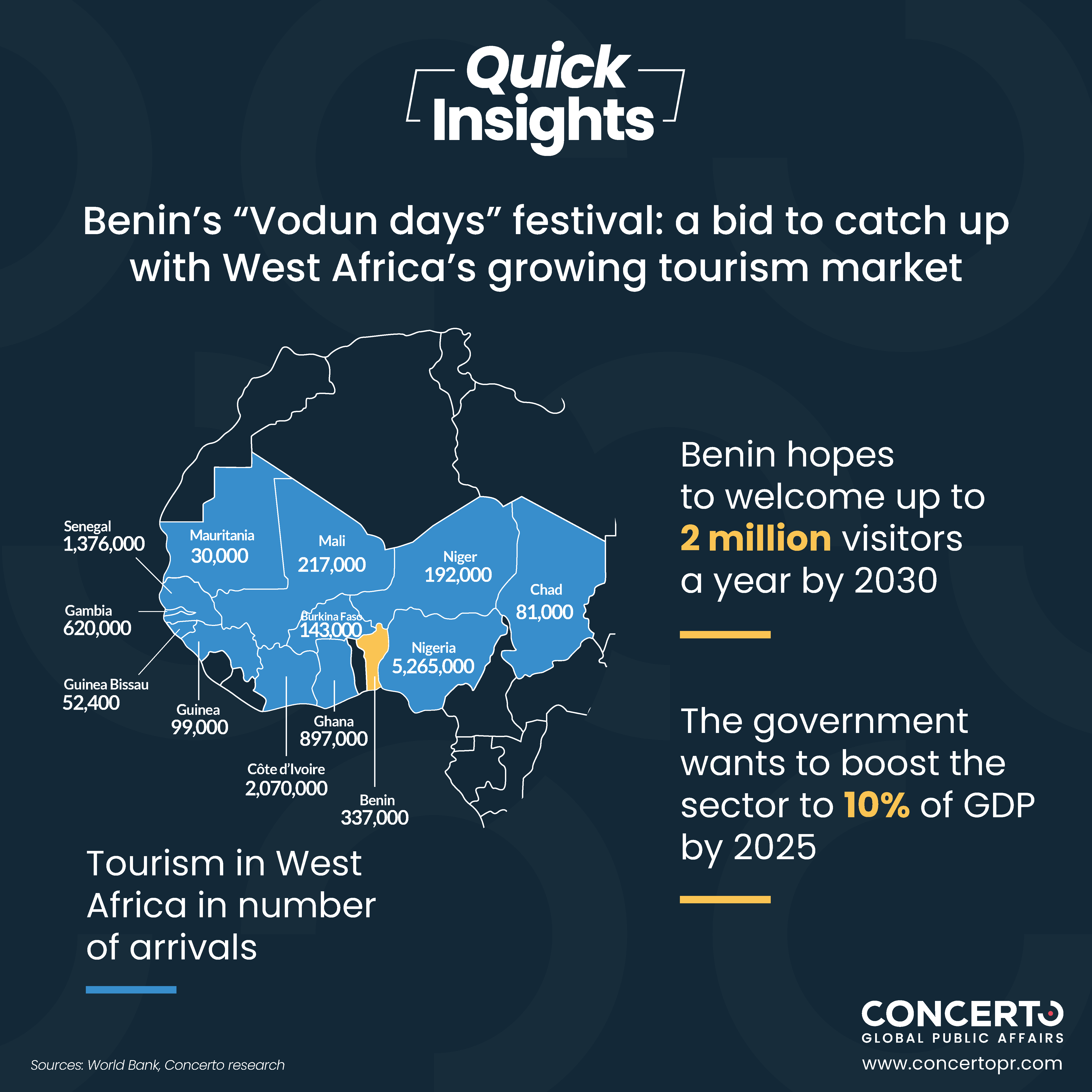

Benin’s decision to promote its fabled cult-like religion is a shrewd move by the government to create imagery that will tap into a wider international audience, hopefully leading to greater tourist numbers. Indeed, the Francophone country has historically struggled to meaningfully develop its tourism sector. In 2019, the sector accounted for just 1.67% of GDP, having dropped gradually from around 3% in the 1990s. To ramp up income from international tourist receipts, the government hopes to boost the sector to 10% of GDP by 2025. The current administration has embarked on a policy of renovating its tourist infrastructure and building new attractions such as the Museum of West African Art and the International Voodoo Museum. The much-anticipated Sofitel will be opening in June 2024, which should help attract high-end tourists and business travelers. Benin also topped the 2023 ‘Africa Visa Openness Report’ list as the country with the most open visa policy on the continent, which should have a direct positive impact on tourist numbers. It was one of the first African countries to scrap visas for African citizens from 31 countries in 2017. As a result, policymakers hope to welcome up to 2 million tourists a year by 2030, as opposed to hundreds of thousands at the moment.A competitive region

However, despite ambitious plans, the government faces an uphill battle to attract visitors in a competitive region where many other West African countries are also seeking to boost tourism revenues. According to 2019 World Bank data, Benin falls behind other West African countries such as Ivory Coast, Senegal, Ghana, Cape Verde, The Gambia and Nigeria in terms of number of international tourists per year. Ghana, which was ranked the top tourist destination in West Africa by the World Economic Forum in 2021, has found success by positioning itself as a destination for African diaspora in the US who are not entirely sure where they come from in West Africa. In 2019, the country launched a massive PR campaign called ‘The Year of Return’ which encouraged African-Americans to visit Ghana, sweetening the deal by relaxing visa rules for potential tourists. Benin, however, will mostly compete on the Francophone stage with other countries like Senegal and Morocco which have well-established tourist sectors. Senegal, for instance, boasts a variety of landscapes including deserts and mangrove lagoons, as well as the Monument de la Renaissance Africaine which has gained a reputation as a must visit pan-African landmark. The country attracted 1.376 million tourists in 2017, according to the World Bank, compared to just 337,00 in Benin in 2019. In order to compete, Benin will have to invest heavily in its marketing campaign as well as ramping up flight networks to key external markets to ensure that tourists can easily visit the country.Investors bid on a tourist spike

The West African region has historically attracted far fewer tourists than Eastern and Southern Africa, where countries such as Kenya and South Africa have long been coveted by international tourists due to a mix of stunning beaches and safaris. In North Africa too, countries like Egypt and Morocco have consistently attracted more tourists than West Africa’s best performers. According to the UN’s World Tourism Organization (WTO), the region welcomed only 12% of tourists headed for sub-Saharan Africa in 2017. However, starting from a modest base, the region is now starting to flex its muscles and has a huge potential for growth. Cape Verde, for example, has almost doubled the number of visiting tourists from 336,000 in 2010 to 758,000 in 2019. Togo saw an even greater increase moving from 202,000 in 2010 to 876,000 in 2019. While data on the growth of the sector across the region is sparse, one indicator to watch is investment in hotel developments per region. According to the 2021 W-Hospitality Pipeline Report, over 50% of hotel developments in Africa are in West Africa, with the region expected to have the highest number of hotels and rooms compared to Southern and Eastern Africa. This demonstrates that investors are betting on a tourist spike in the region, backed by countries like Benin that have rolled out strategies to tap into regional and global tourist flows.