Back

The impact of illicit financial flows (IFFs) on African economies

24 November 2021

Analysis

Recent investigations that have exposed offshore dealings, such as the Pandora papers and the Congo Hold-Up, show the scale and the impact of illicit financial flows (IFFs) on African economies.

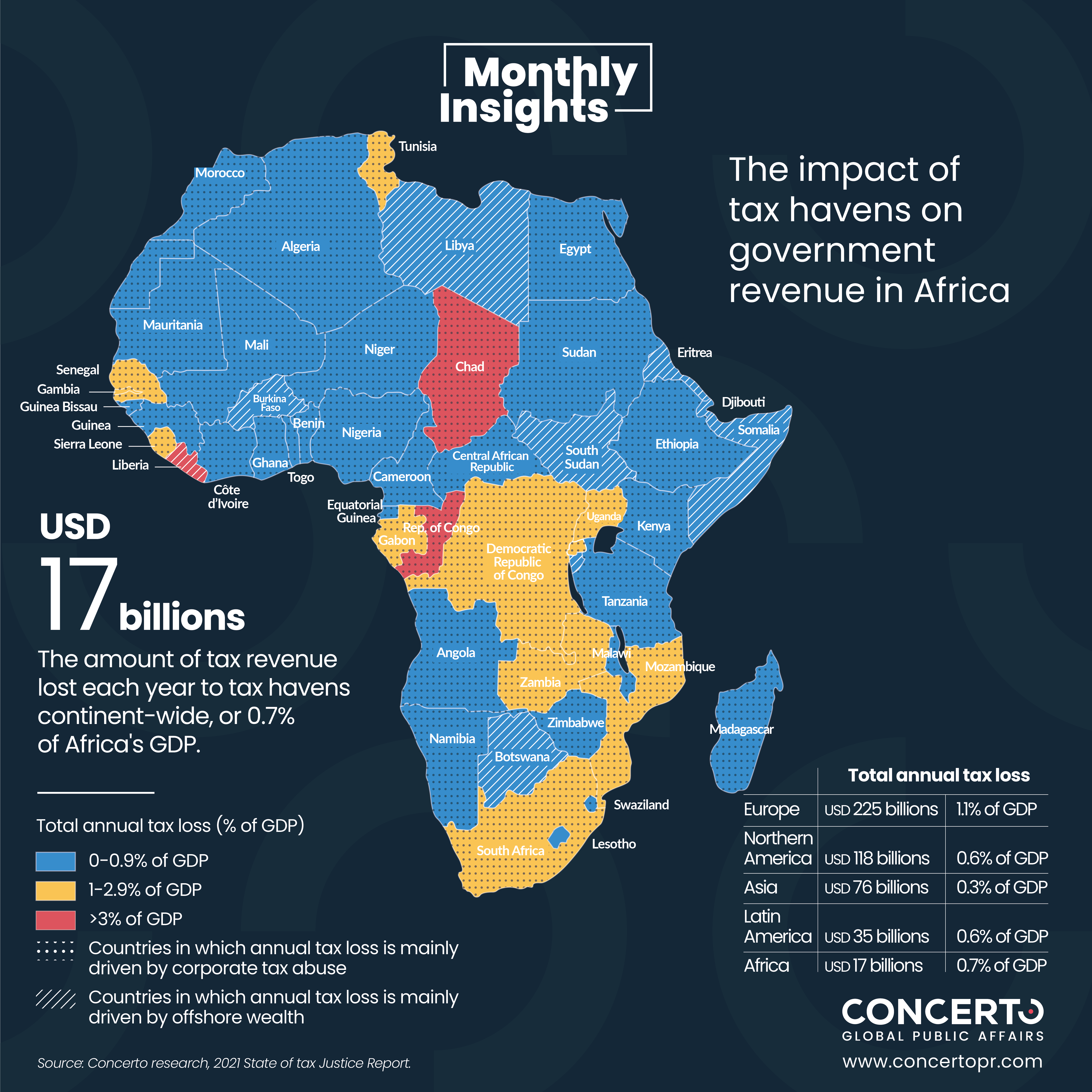

As countries cushion the impact of the prolonged economic crisis caused by the COVID-19 pandemic, addressing tax evasion has become more important than ever. The State of Tax Justice 2021 report released in November reveals that while the volume of IFFs in absolute terms is lower in Africa than in other regions of the world, its impact on tax revenues is far more important across the continent. The report estimates that USD 483 billion is lost each year to tax havens, of which USD 17 USD billion is lost to African governments, due to cross-border corporate tax abuse and offshore tax abuse by wealthy individuals and enabled by large economies such as the US and the United Kingdom. This contributes to lower tax revenues, weakens the provision of public services and undermines government’s ability to redistribute.

Across the continent, several organisations and initiatives have emerged to tackle the challenge of illicit financial flows. The African Tax Administration Forum, which was established in 2008 with 37 member states, advances policy and regulatory discussions on tax reforms. The African Parliamentary Network on Illicit Financial Flows and Taxation, which was launched in 2015, brings together legislators from 11 African countries, providing a platform to discuss tax governance and promote best practices. Multilateral tax transparency efforts have accelerated in recent years with the establishment of the High-Level Panel on Illicit Financial Flows from Africa, which published a report in 2015 on the causes of IFFs. In May, the Organisation for Economic Cooperation and Development (OECD), the African Union, the World Bank and the African Tax Administration published a report entitled, ‘Tax Transparency in Africa 2021’, assessing the progress of 34 African countries in curbing illicit financial flows and improving domestic resource mobilisation.

While several African countries are currently debating budgets for 2022, and the OECD is considering introducing a global tax reform, increased attention will be paid to illicit financial flows. The need to identify new sources of revenue to deal with the consequences of COVID-19 and to vaccinate populations are key drivers in the fight against tax evasion. In this context, multinationals operating on the continent as well as wealthy individuals will be subject to increased scrutiny. Going forward, civil society organisations such as the Tax Justice Network Africa or whistle-blowers such as the Platform to Protect Whistleblowers in Africa (PLAAF) will wield considerable influence over the public opinion, and particularly among young voters, who are demanding action from their government.