Back

The African Credit Rating Agency (ACRA), an alternative to the Big Three ?

30 March 2022

Analysis

Credit rating agencies play a major role in the international financial sector, measuring the economic strength of a country. These companies provide a quantified assessment of a state's creditworthiness and measure the risk of debt default by the borrower. In Africa, the demand for borrowing on the international financial markets is growing exponentially. In the context of a post-pandemic global economic recovery, demand is set to further accelerate.

It is within this framework that a credit rating agency will be created on the African continent before the end of 2022. This announcement was made by the director of the African Peer Review Mechanism (APRM), which is attached to the African Union, at an awareness-raising meeting on international rating agencies in mid-March in Accra. This new platform follows a feasibility study of an African credit rating agency undertaken by the APRM since 2018.

A process to design a legal and structural framework for the African Credit Rating Agency (Acra) has been initiated and is expected to take several months. Moreover, while little information has been disclosed so far about the concrete functioning and organisation of the Acra, its objectives have been announced and are multiple: to prepare credit rating assessments; to facilitate a systematic credit rating assessment exercise; to manage post-rating appeals and implementation of recommendations; to assist member states in undertaking periodic financial, political, economic and social impact assessments; or to establish a network of experts and practitioners for better sharing of best practices in international sovereign credit ratings.

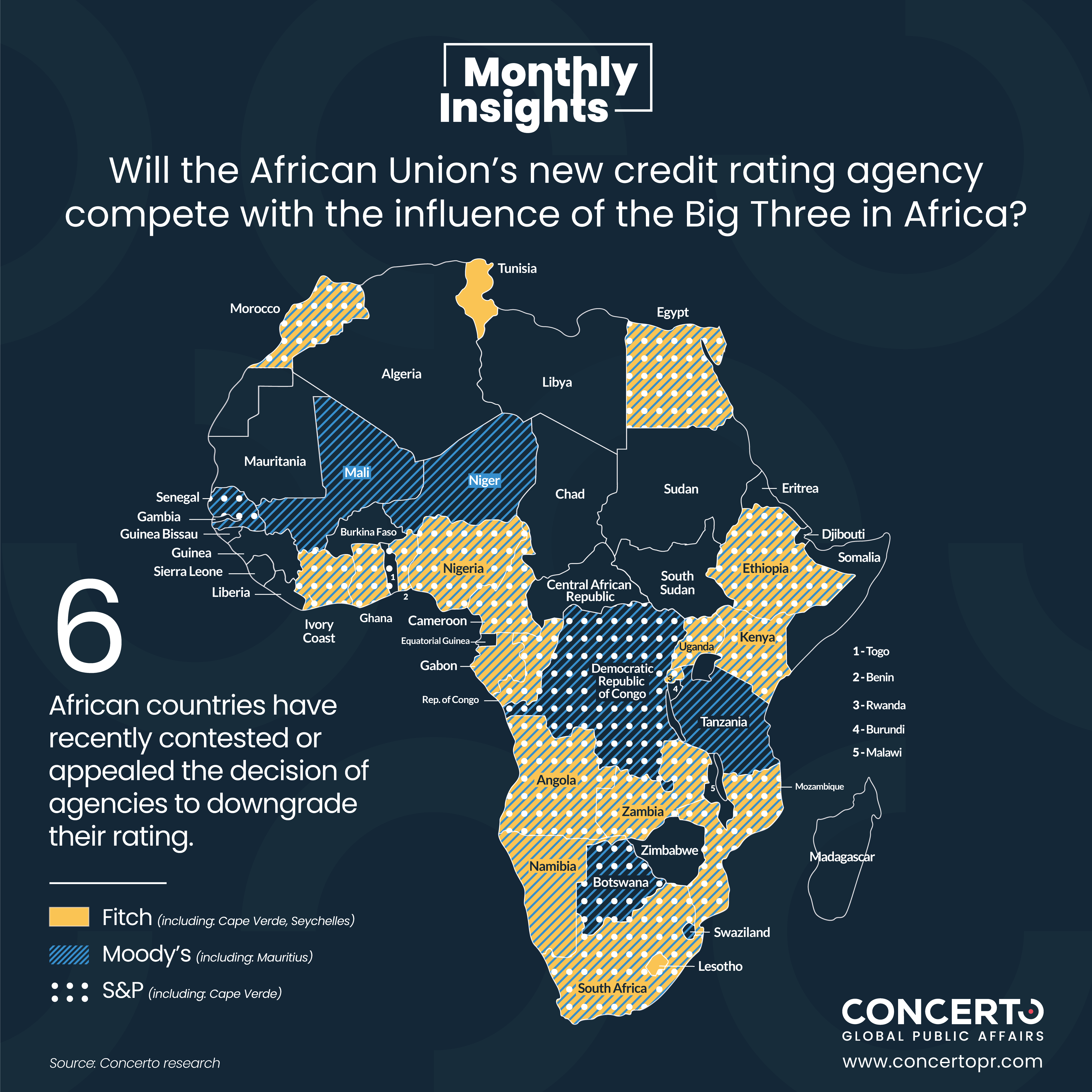

More specifically, the creation of the African Credit Rating Agency is a response to the numerous criticisms made by African governments of the “Big Three”, Moody's Investors Services (Moody's), S&P Global Ratings (S&P) and Fitch Ratings (Fitch). The big three have been regularly accused of bias towards African countries. Research found that African-based rating agencies typically assigned more detailed and significantly higher ratings than those of Moody’s, S&P and Fitch. The Big Three are also called out for their perceived lack of understanding of the domestic context of African economies. The three ratings agencies do not necessarily consult with government representatives during the review process and do not systematically send analysts to conduct field visits in rated countries. Moody’s and S&P cover respectively 28 and 19 countries with a single office in South Africa, while Fitch has no presence in Africa.

In recent years, more and more African countries have denounced their dominance and their methods. Ghana, which recently had its sovereign rating downgraded by Moody's in early February 2022, accused Moody's of failing to consider key information in its assessment and of refusing to give a new credit analyst sufficient time to fully understand the Ghanaian economy before the assessment. In 2017, the Namibian government also denounced the rating agency's misleading and erroneous analyses and interpretations, while Nigeria criticised in 2016 and 2017 the rating agency's failure to take into account efforts to improve the country's economic situation. The Zambian government was one of the first countries to speak out against the hegemony of these agencies, criticising as early as 2015 the lack of exchanges and discussions between the government and the rating agency before the new rating was published. Over the years, several African countries have appealed a rating, but none have been successful. In the absence of an appeal authority or competent authorities to oversee the regulation of international rating agencies, there is no official body that can pronounce a decision on this matter.

The stakes are high for the African Credit Rating Agency. ACRA will be expected to challenge the negative bias against African countries. Concurrently, the home-grown credit rating agency will face stiff competition. Other pan-African rating agencies already exist, such as Bloomfield Investment Corporation in Côte d'Ivoire. Moreover, in February, Moody's announced its decision to buy a 51% stake in Global Credit Rating (GCR), Africa's largest rating agency which accounts for most of all ratings issued on the continent. It is in this context that ACRA will need to establish itself as a credible and sustainable alternative to traditional international rating players.