Back

Renewed interest in African gas: what’s at stake?

31 May 2022

Analysis

Since the start of the Russia-Ukraine conflict, several African countries have attempted to position themselves as credible alternatives to Russian gas and have been the focus of a great deal of interest, particularly in Europe. In addition to the immediate economic opportunities that this brings for these gas-rich African markets, this new state of affairs could enable these countries to design and finance a just and fair energy transition.

Russia's invasion of Ukraine has profoundly disrupted oil and gas supply chains all over the world. A dozen or so days after the start of Russia’s invasion of Ukraine, the European Commission published a new “REPowerEU” programme, detailing Europe's strategy for phasing out its reliance on Russian gas, which accounts for 35% of Europe’s consumption. Although no specific mention was made of Africa in the strategy, its focus on identifying non-Russian suppliers implicitly shifts the focus to the continent. Over the last few months, several European countries have shown a sudden interest in African gas as a way of diversifying their supply chain.

The race for gas supply deals

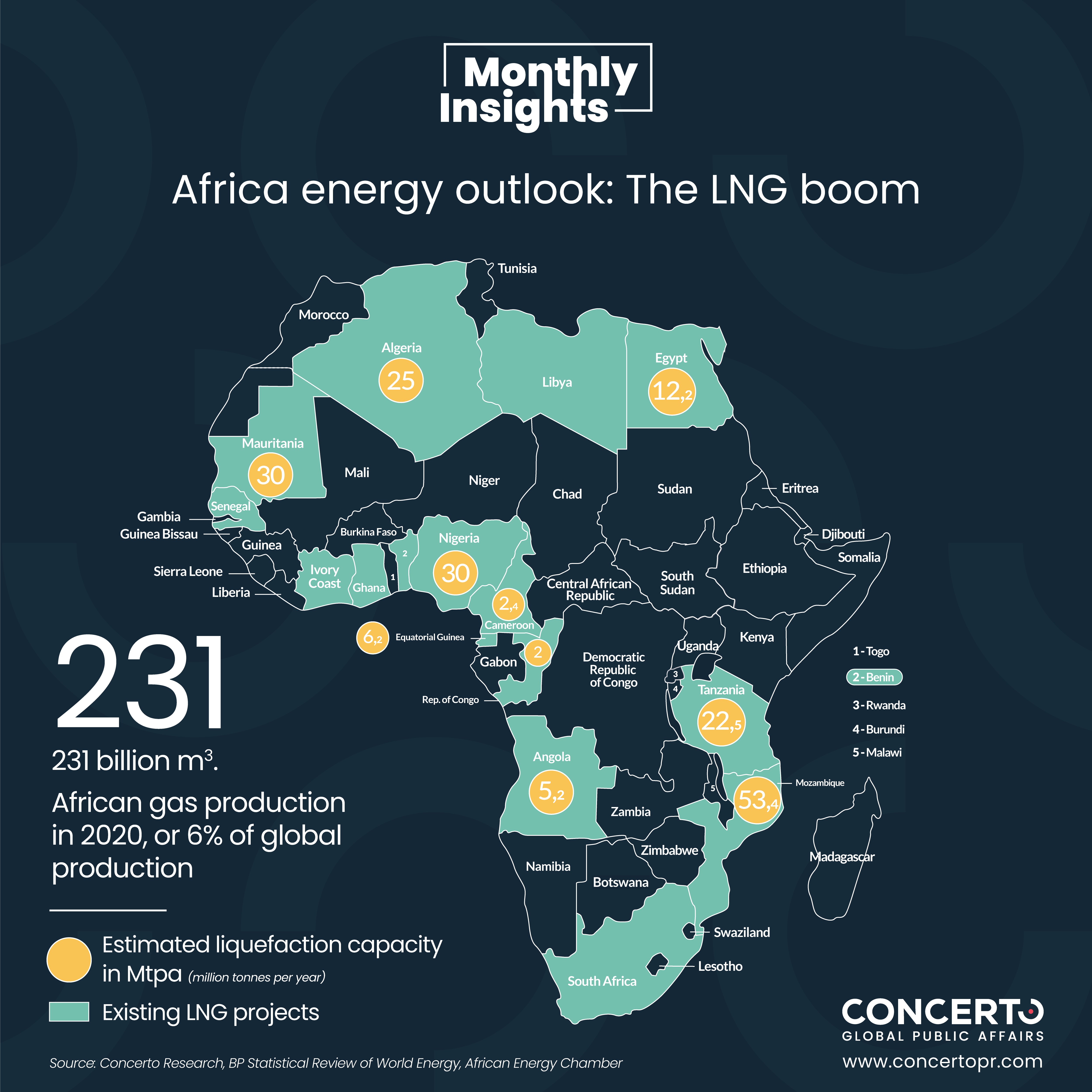

Nigeria and Algeria, Africa’s two biggest natural gas exporters, with respectively 35,000 and 40,000 million cubic metres sent overseas in 2020, are in the spotlight. To meet the growing demand, Nigeria is planning to increase its gas production from 23 to 30 million tonnes over the next five years. This should establish it as one of the leading suppliers to the European Union in the next few years. In February, Margrethe Vestager, the Vice President of the European Commission and Yemi Osinbajo, the Nigerian Vice President agreed to “explore all options for increasing supplies of liquefied natural gas from Nigeria to the EU”. Algeria, which already supplies large quantities of gas to Portugal and Spain, signed new agreements with Italy as part of President Tebboune’s visit to the Italian peninsula in May. Alger is planning to supply up to 3 billion m³ of gas to Italy by developing new gas fields; and it has recently committed to increasing it supplies to France via the Transmed pipeline. In the same vein, German Chancellor Olaf Scholz recently kicked off discussions with Senegal as part of Germany's bid to reduce its reliance on Russian gas. Starting in September 2023, Senegal and Mauritania will start developing the Grand Tortue gas field, which contains some 15 trillion ft³ of gas.Increased investment in major gas fields and related infrastructure

Current and upcoming investments in sub-Saharan natural gas could enable the region to double its gas production by 2030. Over the last two years, Mozambique has stepped up its investment in three LNG projects: Mozambique GNL, Coral Sud FLNG and Rovuma GNL. This should set the country on a course to becoming one of the world’s biggest gas exporters by 2023. Although there has been relatively little in the way of discussion between Mozambique and European countries about gas supply agreements, talks are expected to pick up pace over the next few months. Niger has recently signed agreements with Algeria and Nigeria to build a 4,000-km trans-Saharan pipeline which should eventually be able to carry 30 billion m³ of gas annually. Further east, Egypt is currently seeking to establish itself as a key destination for processing and re-exporting natural gas. Egypt’s Energy Minister Tarek El-Molla recently announced two new pipeline projects to connect New Capital and Dahshur and Sulaymaniyah to the north of Gizeh, alongside work to extend the gas infrastructure in the western desert. Tanzania has entered negotiations with a number of international energy companies – including BG, Ophir Energy, Exxon Mobil, Equinor, Shell and Pavilion Energy – about plans to build the LNG export terminal in Lindi. Following the discovery of multiple new gas fields in recent months, several other African countries, considered newcomers in the gas sector, could also seize this opportunity to attract new investors. Uganda is one such example, alongside Ivory Coast and Namibia. On 12 May, the latter announced the creation of a sovereign fund of USD 18 million following the discovery of gas reserves in the offshore Orange basin.What’s at stake

The boom in African gas looks set to play a key role in the continent’s energy transition. In terms of greenhouse gas emissions, natural gas remains the most environmentally friendly fossil fuel. It emits lower quantities than oil and coal and is considered the best medium-term transition fuel. Africa’s energy transition remains a thorny issue between EU nations, advocating for exiting fossil energies as quickly as possible, and African leaders, who are pushing for an adapted and progressive transition – one that will involve exploiting fossil energy reserves for the next decades. As stressed by Akinwumi A. Adesina, President of the African Development Bank, “Africa cannot bank solely on renewable energies – because of their intermittent nature. It needs to combine renewable energies with natural gas so as to ensure a safe and stable energy supply, and improve people's access to it”. In this context, developing new gas projects, under a climate-conscious regulatory and policy framework, could provide African nations with the financing that they need to roll out their own energy transition model.