Back

Investment in Africa: Analysis of record growth

4 October 2022

Analysis

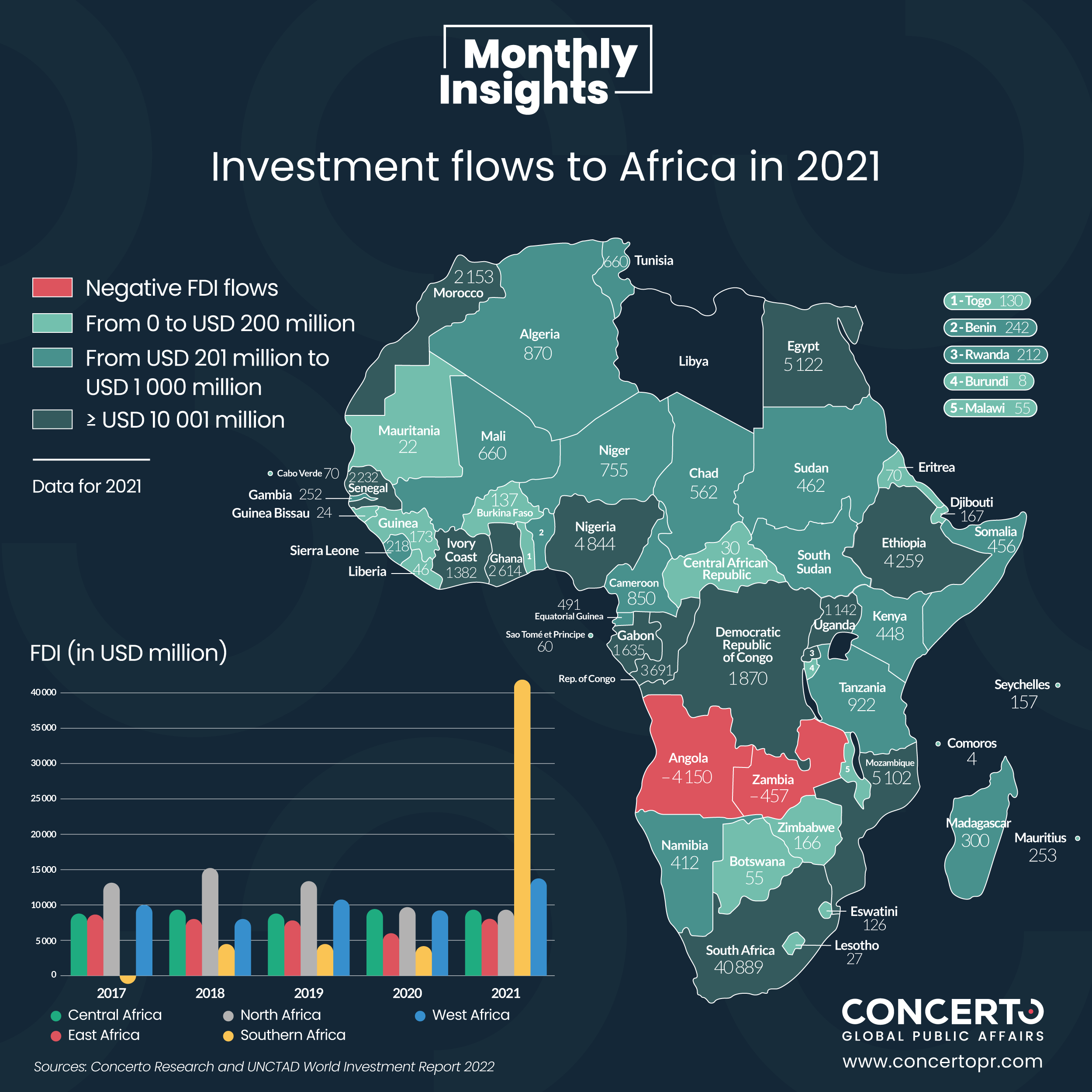

At the global level, the recent report of the United Nations Conference on Trade and Development (UNCTAD), indicates a strong increase in foreign direct investment in 2021. It reached 1,580 billion dollars, an annual increase of 64%. Exceeding this global trend, FDI flows to Africa have increased by 113% to USD 83 billion. In addition to numerous cross-border mergers and acquisitions, the acceleration of digitalisation and investments linked to the energy transition are behind this growth. While Africa remains the least integrated region in the world in terms of FDI flows, the boom in renewable energy projects and digitalisation offers promising prospects.

Southern and West Africa: favoured destinations for investors

South Africa has propelled the whole continent's FDI flows, notably through the share swap between Naspers and Prosus in the last quarter of 2021. The country was the largest recipient of foreign investment, with nearly USD 40.889 billion, or almost half of all investment on the continent. West Africa was the second most attractive region, with a 48% growth in FDI flows. Nigeria and Ghana were the two main drivers of this growth, with investments targeting the extractive sector, gas and oil for the former and gold for the latter. East Africa, the third most dynamic region, saw a 35% increase, almost half of which went to Ethiopia, the central hub of China's Belt and Road initiative. In Central Africa, FDI flows were relatively stable compared to 2020, with a few exceptions such as the Democratic Republic of Congo, which benefited from an increase in investments (+14%) in the oil and mining sectors. Despite a 5% decline for North Africa, Egypt retained its place as Africa’s second largest FDI “champion”, with nearly USD 5.122 billion invested mainly in greenfield projects.Sectors with tremendous growth potential

The energy transition has been one of the main driving forces for new projects. African governments' efforts to meet the sustainable development goals of Agenda 2063 have accelerated massive investments in hydro and solar power, as well as in the new “green gold”, hydrogen. Australia's CWP Renewables, for example, has announced a USD 40 billion investment in the “AMAN” project in Mauritania, which is expected to produce 1.7 million tonnes of green hydrogen per year. The digital sector is also undergoing a revolution accelerated by the sanitary crisis. Many projects have been announced, including in South Africa, Kenya, Nigeria, and Egypt. In South Africa, for example, US data centre specialist Vantage Data Centres has announced a USD 1 billion investment in the construction of Africa’s largest data centre campus. Located in Johannesburg, the facility is expected to offer 80 MW of IT capacity. Furthermore, in April 2022, Kenya unveiled its master plan for the development of the national digital industry over the next ten years (2022-2032). In line with the 2014-2017 strategy, this plan aims to increase investment in the digital sector. The extractive sector continues to attract investors in Africa. A considerable number of projects have been identified in 2021, including in Ghana with the USD 850 million investment in a gold mine in the Ahafo region of northern Ghana by the US mining company Newmont Corp and the construction of a cement plant by Ciment d'Afrique (CIMAF) worth USD 436 million. More recently, in February 2022, Total announced a USD 10 billion investment in a pipeline project in Uganda.What is next?

Despite the tightening of monetary policies in response to inflationary pressures and increased geopolitical risks, investment growth forecasts in Africa are positive. This is mainly due to the asymmetric nature of the commodity price shock, which benefits the largest oil exporters, notably Algeria and Nigeria. In addition, the war in Ukraine has led to a renewed interest in the gas sector in Africa, due to the need for Western countries to find an alternative to Russian hydrocarbons. At the same time, Western efforts to accelerate its energy transition should increase investment in rare metals. Finally, the increase in investment in African start-ups is expected to continue in 2023. They had reached USD 5 billion dollars in 2021, triple their value in 2020. This record could be reached or surpassed by the end of 2022, with over USD 2.3 billion raised by June. These figures bode well for 2023, which should be marked by improved fiscal conditions and a better business climate. About the author Carine Gazier is a project consultant at Concerto, she focuses on political-economic issues and the energy sector in Africa. For further insights and analysis, or to better understand how Concerto can support your business, please email insights@concerto-pr.com.