International borrowing: As African countries come back on the market, what are the strategic priorities?

About

Clara Dias Tomada is an analyst at Concerto. Specialising in international relations and affairs, Clara focuses on global geopolitical issues. Contact Clara at her e-mail address, cdt@concerto-pr.com, for more information on the subject, or to find out more about how Concerto can help you.

QUICK INSIGHTS

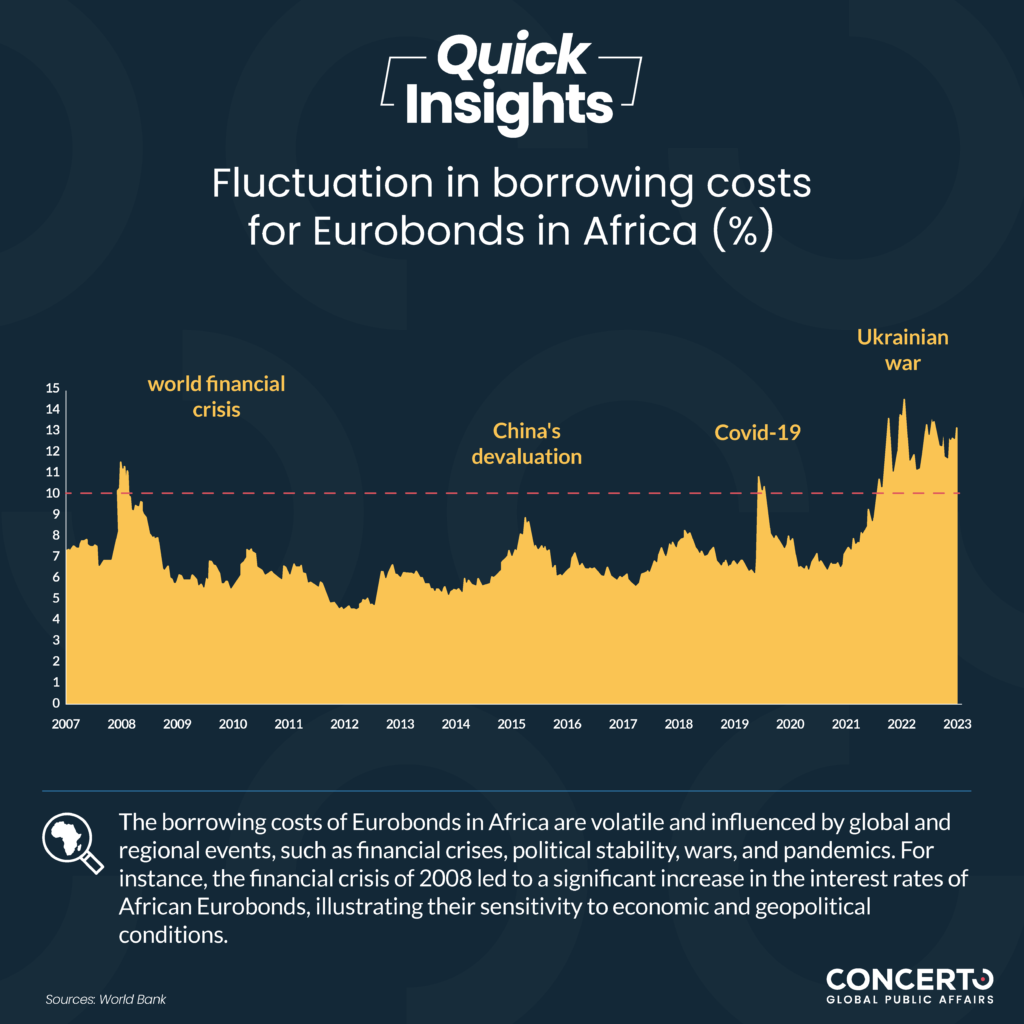

Borrowing on the international markets is common practice for governments around the world. But it is a source of finance that African countries have been unable to access over the past two years, due to a number of factors: the Covid-19 pandemic, the war in Ukraine and difficulties with local currencies.

These multiple obstacles have turned potential investors away from these emerging economies, due to the high investment risk.

Despite these challenges, African countries are making a comeback on the international loan markets in 2024. This resurgence raises questions about the way in which this new financing will be implemented and about the issues involved.

At the heart of this recovery strategy are Eurobonds, debt instruments offering considerable financial flexibility. They allow emerging countries to raise capital in a foreign currency, thereby diversifying their sources of financing and exposure to global markets.

Classified by currency, such as the Eurodollar or the Euro-Yen, Eurobonds have become a preferred choice for investors looking to diversify their portfolios.

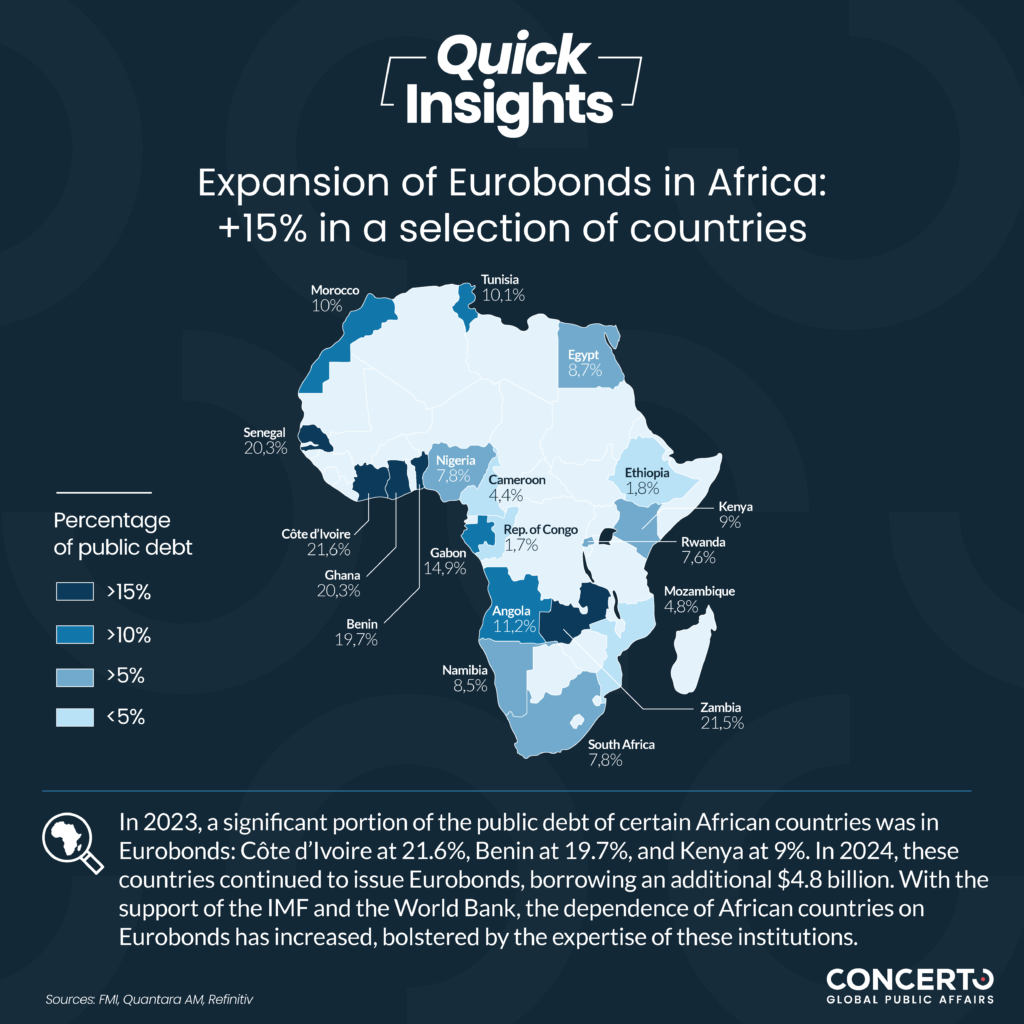

Last January, Côte d’Ivoire raised $2.6 billion through two bonds with maturities of 9 and 13 years. These 8.5% bonds, according to Bloomberg, raised more than $8 billion, a record for a West African sovereign issuer.

Following this example, Benin issued a USD 750 million 14-year bond at 8.375% in February, its first ever dollar-denominated bond. Kenya, East Africa’s largest economy, followed this example by issuing a seven-year bond worth $1.5 billion at a rate of 10.375%.

Recent successful issues by Côte d’Ivoire, Benin and Kenya indicate an improvement in global financial conditions. Angola and Nigeria, although facing high inflation rates since 2023, are also likely to follow suit, underlining an emerging regional dynamic.

These advances mark an important step in the return of African nations to the international debt markets, but they also raise the crucial question of what strategic priorities these countries should adopt to ensure their sustainable financial success. Although the road to economic recovery is fraught with difficulties, investors remain cautious due to inherent risks, such as economic and political instability in some regions.

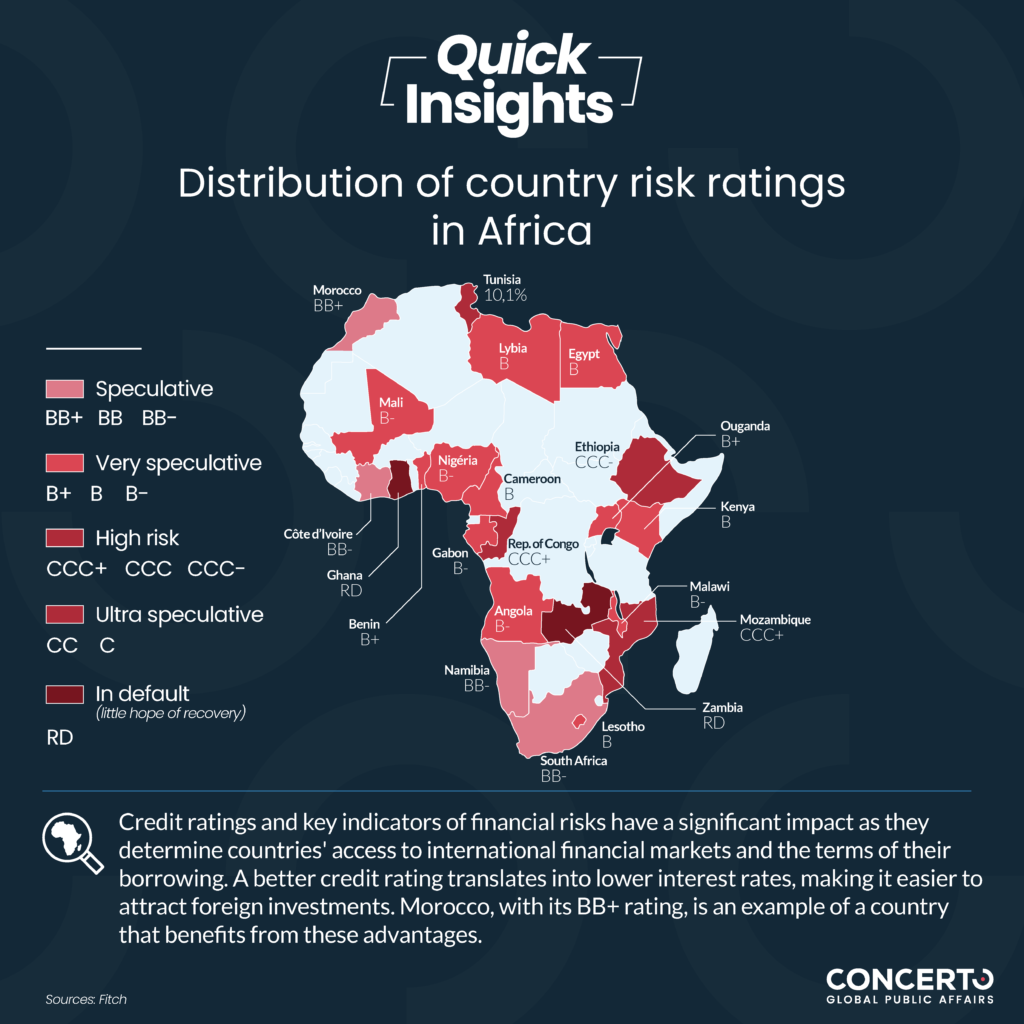

Faced with these challenges, it is essential that African countries put in place robust strategies to ensure the sustainability of their debt. This means focusing their efforts on managing political and economic instability, establishing effective taxation and improving their country risk ratings.

In this context, the ratings put in place by agencies such as Fitch and Moody’s are of vital importance. They are used to assess the risks of investments. A good rating, obtained through rigorous management, enables bonds to be issued successfully. In addition, a successful bond issue, carried out in conjunction with financial institutions, can help to improve this rating.

In 2024, despite the obstacles that remain on the path to economic recovery, significant progress is being made. Encouraging signs are emerging thanks to the efforts made by many countries to increase their attractiveness to investors. These initiatives, focused on reforms in infrastructure, the business climate and key sectors such as agriculture and technology, are supported by international financial institutions including the IMF and the World Bank.

Découvrez nos autres case studies

Showcase the expertise of an international supplier of ICT services

Increase the visibility and raise the profile of a pan-African institution

Promote the image of a Central American country

Increase the influence of a pan-African logistics infrastructure company and raise its profile