Africa Electoral Watch | South Africa 2024 - Pre-electoral analysis

AFRICA ELECTORAL WATCH

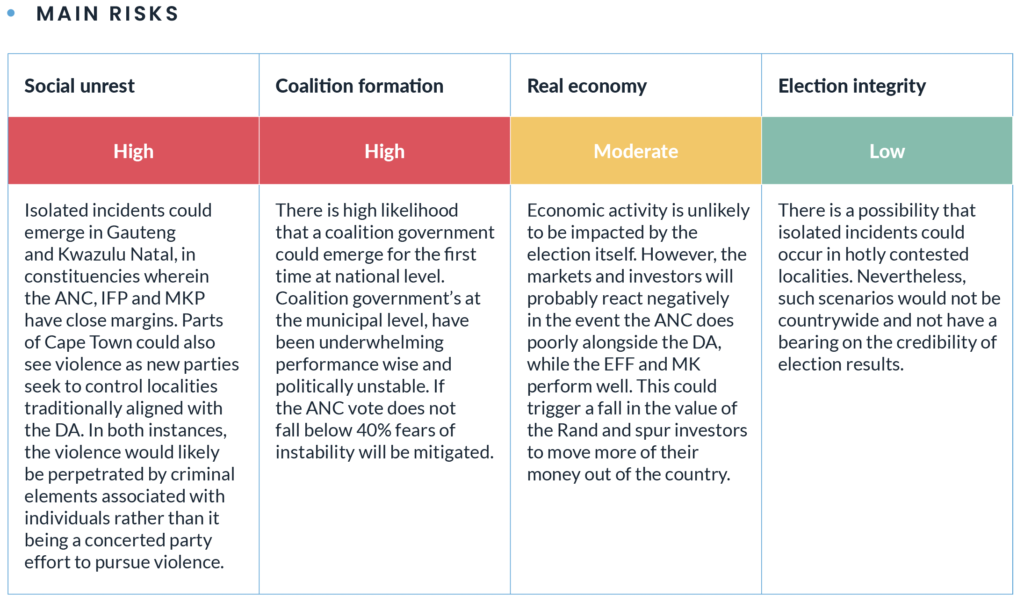

The 29th of May will commemorate the 30th anniversary of the end of apartheid and the adoption of an inclusive constitutional democracy in South Africa. This upcoming general election is anticipated to be the most fiercely contested since the 1994 polls. President Cyril Ramaphosa’s first term has been marred by corruption, economic stagnation, poor service delivery, rising crime and insecurity as well as infrastructure decay. The ruling African National Congress (ANC) attributes these shortcomings to a combination of factors including the legacy of the previous administration’s failures, the COVID-19 pandemic and the July 2021 insurrection in the Gauteng and KwaZulu Natal provinces. Despite manifested unpopularity, the ANC will ultimately emerge victorious due to incumbency advantage, the party’s nationwide implantation, its role in uplifting the livelihoods of large segments of the black population and its historic role in ending apartheid. However, established opposition parties including the Democratic Alliance (DA), Economic Freedom Fighters (EFF) and Inkatha Freedom Party (IFP) alongside the newly formed uMkhonto Wesizwe (MK) aim to secure enough votes to ensure the ANC falls below the 50% vote threshold. This would prevent the party from obtaining an outright majority and enable opposition parties to participate in the formation of a coalition government.

KEY TAKEAWAYS

• The ANC will win the election but is likely to lose its hegemonic party status and could potentially have to form a coalition government, fueling instability

• Former President Jacob Zuma’s MK party will likely become the country’s fourth largest political and could possibly become a member of a national coalition government or at the KwaZulu Natal provincial government level

• Despite introduction of independent candidates, their overall impact will be marginal

• Voter turnout will be a key factor, as low turnout, especially amongst youths will likely bode well for the ANC

• The ANC and DA have adopted policy manifesto’s that aim to promote market-friendly policies, while the EFF and MK have advocated for the implementation of economic redistribution initiatives that could scare investors

WHAT TO LOOK OUT FOR?

Zuma’s MK unknown influence

A key factor confirming the competitive and unpredictable nature of the 29 May contest is whether former President Jacob Zuma and his upstart party uMkhonto Wesizwe (MK) could contribute towards reducing the ANC’s vote share. The MK, named after the ANC’s armed wing during the apartheid era, wants to change South Africa by “moving the country away from constitutional supremacy toward unfettered parliamentary supremacy”. It also wants to nationalise banks and mines, expropriate land without compensation and expand the country’s already extensive social welfare system. The party, however, lacks a solid support base, with Zuma having mainly campaigned in his native KwaZulu Natal province and party members appealing to Zulu constituents in Gauteng and Mpumalanga provinces. Gauteng and KwaZulu Natal have the highest number of registered voters (6.5 and 5.7 million respectively), therefore obtaining votes from there will be important. Besides capitalising on ethno-regional affiliations, the MK aims to mobilise undecided ANC members, and the party’s anti-Ramaphosa faction, which has largely been neutralised but still has prominent members in positions of influence. Whilst Jacob Zuma is still a popular figure, the general understanding that he was central in fostering many of the country’s current problems as well as the party’s deliberate courting of the Zulu vote, will likely dissuade voters from electing the MK at the national level. The ANC could potentially benefit from recent rifts within the MK, stemming from allegations of unauthorised meetings with the ANC and financial impropriety. This has led to the recent dismissal of leading figures including its founder Jabulani Khumalo. Furthermore, it will prove difficult for the MK to draw votes from supporters of the EFF and Inkatha Freedom Party (IFP), who respectively share the same policy agenda and have the same target constituents. The May 20 decision by the Constitutional Court to bar Zuma from standing as a parliamentary candidate will prevent him from having an additional platform to criticise the ANC and raise his popularity. It will also end any chance of being named to national government if the ANC forms a coalition with the MK. Zuma still remains as party leader and is likely to use the verdict to justify previous claims that the judiciary has vendetta against him. Regardless, the MK still has the possibility of entering into a coalition with the ANC in the KwaZulu Natal province government.

Uncertainty on voter turnout

The low registration of young voters combined with the uncertainty of turnout could work in the ANC’s favour, enabling

it to achieve a score sufficient to avoid making major political compromises. Figures disclosed by the Independent Electoral Commission (IEC) show that the 18-29 age band is the electoral bloc that register the lowest for elections, with only 44.6% of this demographic having registered to vote. The low youth registration figures, in contrast to their day-to-day political participation, can be explained in several ways, the first of which is the loss of confidence in the country’s politicians and democratic institutions. An Afrobarometer survey released in March shows that 70% of South Africans are dissatisfied with the way democracy is working in their country, while 83% of them believe that the country is heading in the wrong direction. This scenario is not unique to South Africa, with neighbouring Namibia and Zimbabwe registering 76% and 72% population dissatisfaction rates. Nevertheless, countrywide power outages, water shortages in Gauteng, the effect of COVID-19 on the economy and various corruption scandals have fuelled public anger against the ruling elite. This in turn led to the rise of the EFF, which has made combating these issues its credo. Another factor that could lead to a further drop in participation, which went from 77% in 2009 to 66% in 2019: mobility restrictions on voters. This year, voters can now only vote at the voting station/district where they are registered, whereas, registered voters used to be able to vote anywhere in the province, provided they completed the requisite forms.

Navigating uncharted territory

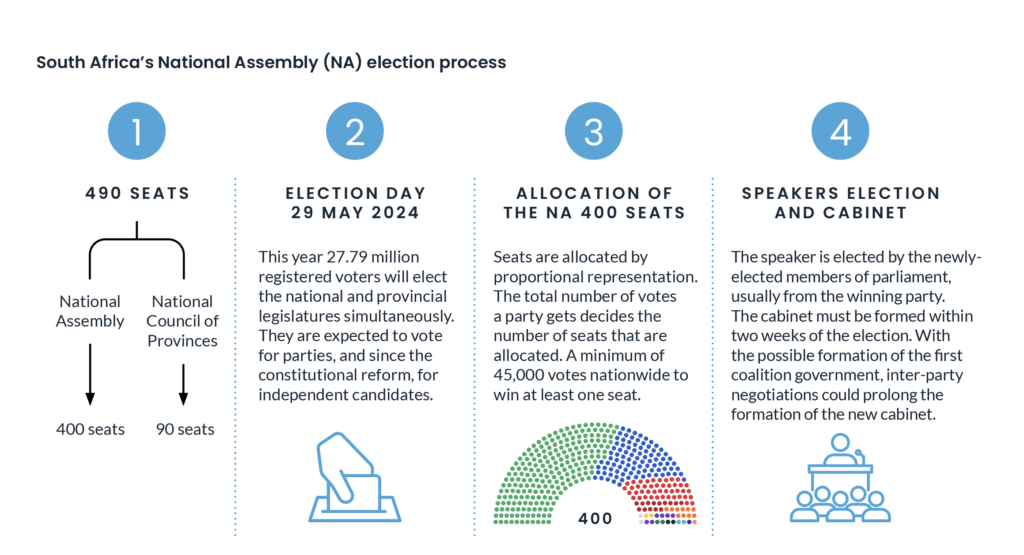

This election will usher South Africa into a new political dispensation, with the ANC expected to lose its dominant party status. In the event it is able to obtain at least 50% at national level, it is still likely to lose control of Gauteng province, the country’s economic heartbed and could experience further losses in the 2026 municipal election. South Africa’s electoral system is a closed-list proportional representation system. Whilst bigger opposition parties are vying to potentially join an ANC-led coalition government, South Africa’s closed-list proportional representation electoral system allows smaller parties to be represented in institutions. This could see the ANC constitute a government made up of smaller and less influential parties rather than choosing to work with their immediate rivals. An ANC led coalition with smaller parties would see Ramaphosa continue the incremental reform agenda he started in his first term, while ensuring a balanced approach towards the adoption of market-friendly and left-leaning policy stances. An ANC-DA coalition would see the implementation of more business friendly initiatives, especially to improve power generation and public procurement. Restructuring key state-owned enterprises including Eskom and Transnet and promoting small and medium-sized businesses would also be pursued. An ANC-EFF coalition would potentially see the adoption of EFF-endorsed policies such as corporate tax increments, a raised minimum wage, fast-tracking land expropriation and increasing state involvement in strategic components of the economy. The extent to which such policies are pursued would be dependent on the EFF’s vote share and if it is granted cabinet portfolios in the economic pole.

An evolving opposition political landscape and new electoral rules

South Africa’s major opposition parties are likely to maintain prominent positions, however, emerging parties could disrupt voting patterns. The electoral system is designed to favour party systems, but the 2022 Electoral Amendment Bill signed by President Cyril Ramaphosa enables independent candidates to potentially become influential political players. The EFF is poised to improve on the 10.8% score obtained during the 2019 election. The party’s radical left policies have gained appeal amongst urban and middle class black voters as well as the youth, with significant improvement expected in Gauteng and Limpopo provinces. The current largest opposition party, the DA – a party mainly supported by the minority coloured and white population -, is facing growing discontent amongst coloured constituents as well as amongst younger white and middle class black voters. Smaller opposition parties including ActionSA, BOSA, GOOD, Rise Mzansi (all led by former DA members) and the populist Patriotic Alliance (PA) are capitalising on this scenario and vying for votes in the Western Cape province, the DA’s political stronghold. As a result, the DA has primarily campaigned in the Western Cape to retain control there, which could lead to a loss of the national vote. It has also indicated its willingness to join an ANC-led coalition, essentially turning its back on the Multi-Party Charter, an opposition coalition that was established in June 2023. The 2022 Electoral Amendment bill expands electoral participation and widens the pool of leadership choice for the National Assembly and provincial legislatures, with the possibility for independent candidates to contest. This change will allow new anti-system candidates to compete and to gather around their person and influence in a few constituencies.

Discover our case studies.

PR: Concerto welcomes CAPZA as a shareholder

Africa Electoral Watch | Guinea 2025 - Post-electoral analysis

Africa Electoral Watch | Uganda 2026 - Pre-electoral analysis

Africa Electoral Watch | Central African Republic 2025 - Pre-electoral analysis