Back

Africa Electoral Watch | Senegal pre-electoral report

22 March 2024

Analysis

Since February, Senegal has been plunged into a constitutional crisis as a result of the postponement of the presidential election and a series of unprecedented and controversial decisions taken by President Macky Sall. Efforts to alleviate tensions through political dialogue resulted in an even murkier situation.

AFRICA ELECTORAL WATCH

Since February, Senegal has been plunged into a constitutional crisis as a result of the postponement of the presidential election and a series of unprecedented and controversial decisions taken by President Macky Sall. Efforts to alleviate tensions through political dialogue resulted in an even murkier situation, with proposals including a suggested election date of 2 June, an amnesty bill covering acts linked to deadly protests in recent years, and a proposal to resume the candidate selection process. However, most decisions favouring the status quo were overturned by the Constitutional Council. Following a prolonged period of political uncertainty, the election is now set to take place on 24 March, in a context of profound distrust towards the ruling party and by extension, its candidate, former Prime Minister Amadou Bâ. The latter will run against 18 other candidates vetted by the Constitutional Council, a list that however excludes Karim Wade and Ousmane Sonko, two prominent opposition political figures. As Macky Sall’s term of office nears its end on 2 April, uncertainty looms over who will succeed him in these high-stakes elections.KEY TAKE AWAYS

- The first round of the presidential election is scheduled to take place nationwide on 24 March. - The ballot is expected to be a two-horse race between former Prime Minister Amadou Bâ and opponent Bassirou Diomaye Faye. - A major mobilisation is expected on election day, with active participation b coalition wins. - The election is set to be tight, with the risk of widespread unrest if the ruling coalition wins. - Policy-wise, an opposition victory would have significant consequences with a tougher stance on foreign investors.

WHAT TO LOOK OUT FOR?

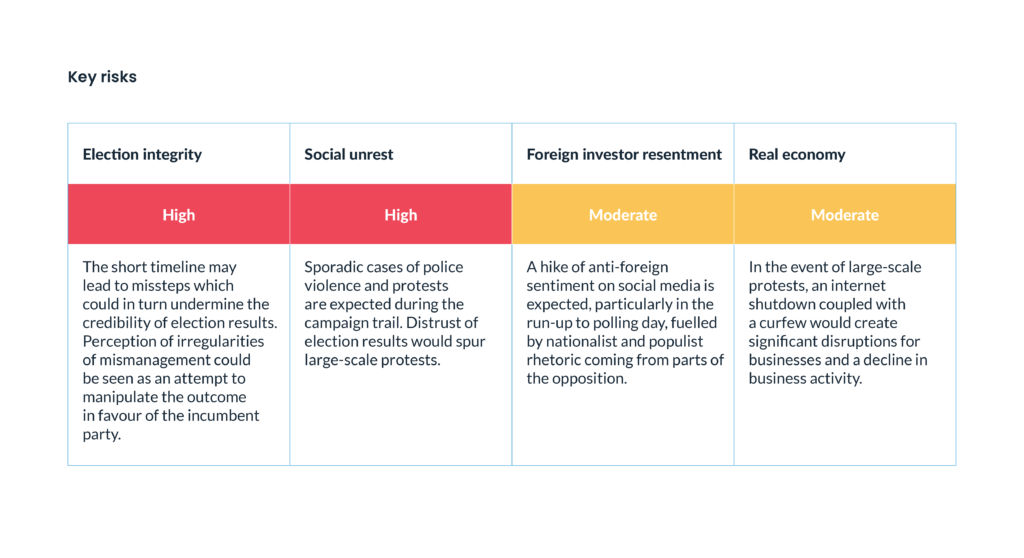

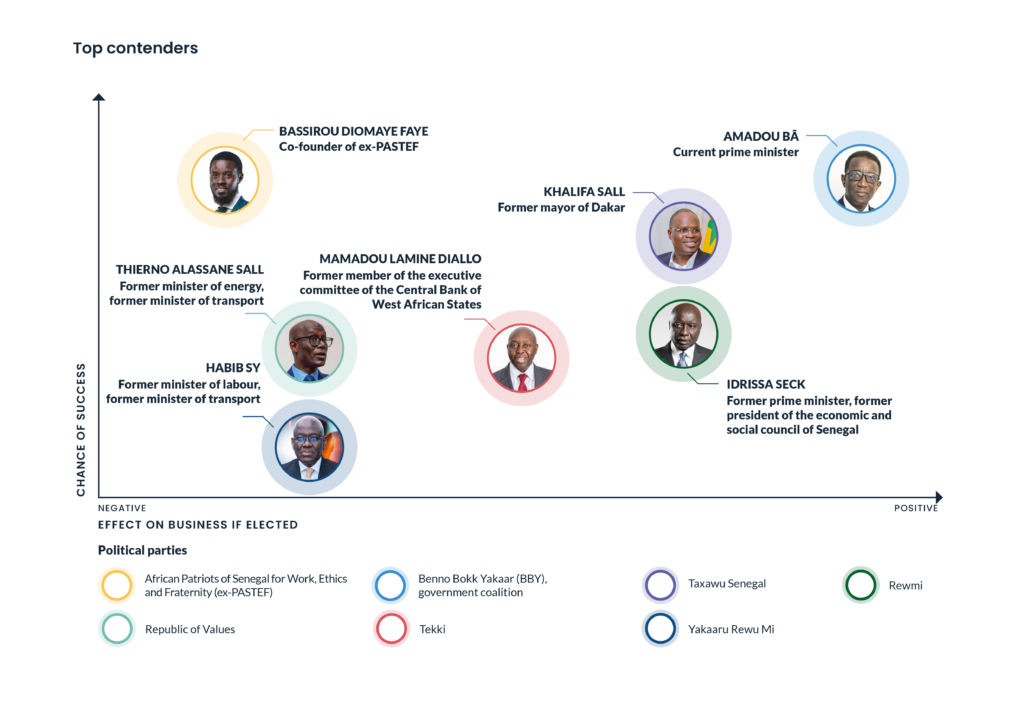

A tight race The ballot promises to be a heated battle between the majority candidate, Amadou Bâ, prime minister until 6 March 2024, and Bassirou Diomaye Faye, substitute candidate of Ousmane Sonko, leader of the opposition party ex-PASTEF. Facing dissent within his own camp, Macky Sall’s handpicked candidate is expected to lead a lightning campaign in the coming days to compensate for recent setbacks and defy the predictions of unofficial polls, which had him losing to the opposition. His victory is far from assured, especially as the Benno Bokk Yaakaar (BBY) coalition has lost supporters as a result of Macky Sall’s latest political moves, which have divided and eroded BBY’s support base. The Constitutional Council’s decision not to reexamine the candidacies of disqualified candidates, including Karima Wade and Ousmane Sonko, means that they will not be able to stand in the election. Brace for turbulence Disruptions to business operations are expected to continue until at least mid-April, with the likelihood of further unrest if the ruling coalition wins. The tight timeline presents a risk for the preparation of polling stations, staff, and bodies responsible for supervising polling day, including the Electoral Commission, which could in turn stir doubts over the integrity of elections. Any suspicion of fraud or malpractice, particularly if the opposition loses, will be used to contest the results and will lead to further demonstrations. Opposition and civil society groups such as FC25 (an alliance of presidential candidates), F24, and Aar Sunu Élection, which recently joined forces to coordinate their fight within the Fippu Resistance Front, will serve as rallying forces for mass protests. In the event of demonstrations, as precedent has shown, Internet blackouts are likely, as well as targeted material destruction, particularly aimed at businesses with ties to France. A victory for the ex-PASTEF party would cause a significant downturn in investor confidence. The party’s anti-imperialist stance might prompt the reevaluation of contracts and agreements, impacting major investments, particularly in the oil and gas sector. A surge in youth mobilisation

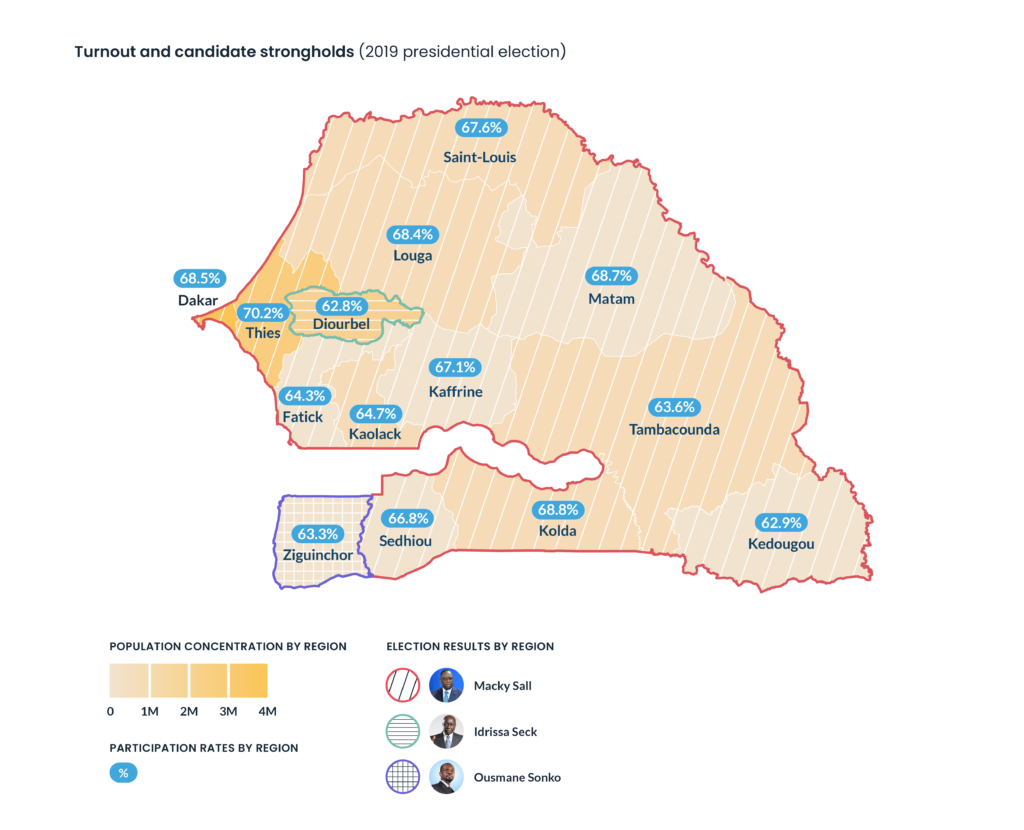

The 2024 presidential elections in Senegal are expected to see a rise in voter turnout, particularly among young people, a trend that will favor the opposition. Back in 2019, the rate of 66.27% was already one of the highest in the country’s history. The ex-PASTEF’s strong anti-system discourse has garnered substantial support from the Senegalese youth, indicating a notable shift in their political engagement. President Macky Sall’s postponement of the elections has exacerbated a feeling of mistrust among citizens, particularly young people, many of whom have expressed their intention to vote in protest, which will contribute to a high turnout. Additionally, the diaspora’s vote, mostly aligned with opposition candidates, may also play a pivotal role. In the July 2022 legislative elections, the ruling party BBY suffered a noticeable setback and nearly lost its majority in parliament. Similarly, during the January 2022 local elections, BBY fell short of its objective to secure a majority in densely populated regions like Dakar and Ziguinchor, both dominated by opposition coalition Yewwi Askan Wi which comprises the ex-PASTEF. The 2019 presidential election showed that over half of the country’s electorate is concentrated in pivotal regions such as Dakar, Thiès, Diourbel, and Kaolack, all of which are projected to experience a surge in voter turnout.

A closely scrutinised ballot

The outcomes of the presidential elections could have major consequences for the stability of the region plagued over the last three years by coups and the increasing risk of terrorism spillover, should the ruling coalition lose the vote. The ex-PASTEF leaders have repeatedly voiced their criticism of the Economic Community of West African States (ECOWAS), and although the risk of a similar withdrawal by Alliance of Sahel States (ASS) countries can be ruled out, they could nonetheless call for a number of changes (tougher stance against anti-constitutional changes, acceleration of economic integration, relaunch of discussion on the common currency) within the zone. This is likely to meet some resistance from other member states. On a wider scale, a victory of ex-PASTEF will lead to a reshaping of cooperation with Senegal’s strategic partners, notably France and the US.

A surge in youth mobilisation

The 2024 presidential elections in Senegal are expected to see a rise in voter turnout, particularly among young people, a trend that will favor the opposition. Back in 2019, the rate of 66.27% was already one of the highest in the country’s history. The ex-PASTEF’s strong anti-system discourse has garnered substantial support from the Senegalese youth, indicating a notable shift in their political engagement. President Macky Sall’s postponement of the elections has exacerbated a feeling of mistrust among citizens, particularly young people, many of whom have expressed their intention to vote in protest, which will contribute to a high turnout. Additionally, the diaspora’s vote, mostly aligned with opposition candidates, may also play a pivotal role. In the July 2022 legislative elections, the ruling party BBY suffered a noticeable setback and nearly lost its majority in parliament. Similarly, during the January 2022 local elections, BBY fell short of its objective to secure a majority in densely populated regions like Dakar and Ziguinchor, both dominated by opposition coalition Yewwi Askan Wi which comprises the ex-PASTEF. The 2019 presidential election showed that over half of the country’s electorate is concentrated in pivotal regions such as Dakar, Thiès, Diourbel, and Kaolack, all of which are projected to experience a surge in voter turnout.

A closely scrutinised ballot

The outcomes of the presidential elections could have major consequences for the stability of the region plagued over the last three years by coups and the increasing risk of terrorism spillover, should the ruling coalition lose the vote. The ex-PASTEF leaders have repeatedly voiced their criticism of the Economic Community of West African States (ECOWAS), and although the risk of a similar withdrawal by Alliance of Sahel States (ASS) countries can be ruled out, they could nonetheless call for a number of changes (tougher stance against anti-constitutional changes, acceleration of economic integration, relaunch of discussion on the common currency) within the zone. This is likely to meet some resistance from other member states. On a wider scale, a victory of ex-PASTEF will lead to a reshaping of cooperation with Senegal’s strategic partners, notably France and the US.